Essay

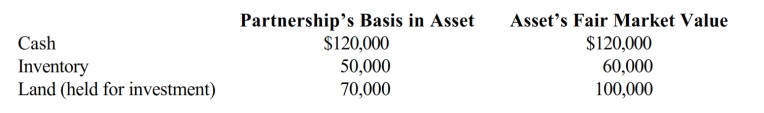

Karli owns a 25% capital and profits interest in the calendar-year KJDV Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $200,000. On that date, she receives a proportionate current (nonliquidating) distribution of the following assets.

a. Calculate Karli's recognized gain or loss on the distribution, if any.

b. Calculate Karli's basis in the inventory received.

c. Calculate Karli's basis in land received. The land is a capital asset.

d. Calculate Karli's basis for her partnership interest after the distribution.

Correct Answer:

Verified

a. No gain or loss. Karli will not recog...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Harry's basis in his partnership interest was

Q48: Match each of the following statements with

Q62: An example of the aggregate concept of

Q63: Jeordie and Kendis created the JK Partnership

Q64: Seven years ago, Paul purchased residential rental

Q65: The Greene Partnership had average annual gross

Q66: Morgan and Kristen formed an equal partnership

Q68: A partner will have the same profit-sharing,

Q69: On August 31 of the current tax

Q138: Match each of the following statements with