Essay

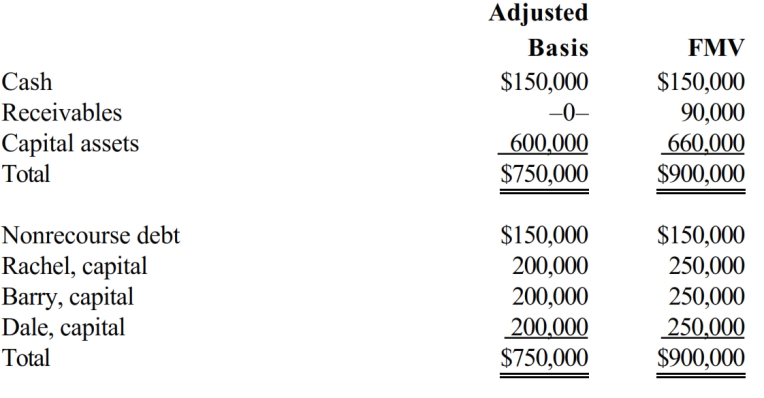

On August 31 of the current tax year, the balance sheet of the RBD General Partnership is as follows

On that date, Rachel sells her one-third partnership interest to Lisa for $300,000, consisting of cash and relief of Rachel's share of the nonrecourse debt. The nonrecourse debt is shared equally among the partners. Rachel's outside basis for her partnership interest is $250,000 (including her share of partnership debt). How much capital gain and/or ordinary income will Rachel recognize on the sale?

Correct Answer:

Verified

Rachel's realized gain is $50,000 ($300,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q31: Harry's basis in his partnership interest was

Q48: Match each of the following statements with

Q64: Seven years ago, Paul purchased residential rental

Q65: The Greene Partnership had average annual gross

Q66: Morgan and Kristen formed an equal partnership

Q67: Karli owns a 25% capital and profits

Q68: A partner will have the same profit-sharing,

Q73: The partner (rather than the partnership) will

Q74: Which one of the following statements is

Q138: Match each of the following statements with