Essay

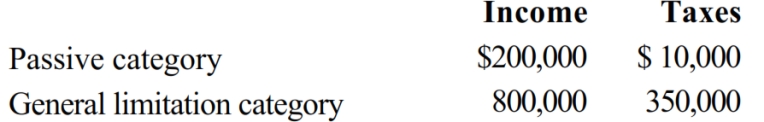

Britta, Inc., a U.S. corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S. taxes before FTC are $336,000 (assume a 21% tax rate). What is Britta's U.S. tax liability after the FTC?

Correct Answer:

Verified

The FTC is computed separately for both ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q21: Given the following information, determine whether Greta,

Q28: Which of the following statements regarding the

Q29: Your client holds foreign tax credit (FTC)

Q30: As to the sourcing rules applicable to

Q31: Wood, a U.S. corporation, owns 30% of

Q58: Waltz, Inc., a U.S. taxpayer, pays foreign

Q84: Which of the following foreign taxes paid

Q112: Zhang, an NRA who is not a

Q122: LocalCo merges into HeirCo, a non-U.S. entity,

Q127: Interest paid to an unrelated party by