Essay

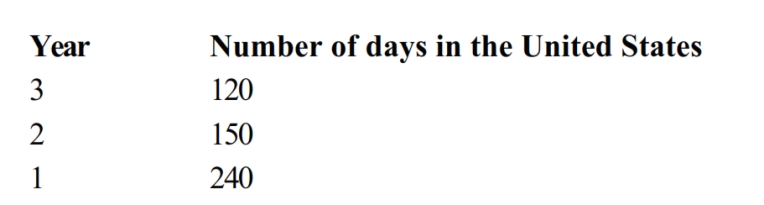

Given the following information, determine whether Greta, an alien, is a U.S. resident for Year 3. Greta cannot establish a tax home in or a closer connection to a foreign country.

Correct Answer:

Verified

In general, for Federal income tax purpo...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q16: The following income of a foreign corporation

Q19: Carol, a citizen and resident of Adagio,

Q26: Britta, Inc., a U.S. corporation, reports foreign-source

Q29: Which of the following statements regarding income

Q57: Wellington, Inc., a U.S. corporation, owns 30%

Q84: Which of the following foreign taxes paid

Q88: The § 367 cross-border transfer rules seem

Q112: Zhang, an NRA who is not a

Q122: LocalCo merges into HeirCo, a non-U.S. entity,

Q127: Interest paid to an unrelated party by