Multiple Choice

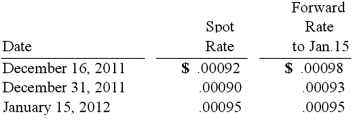

Car Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2011, with payment of 10 million Korean won to be received on January 15, 2012. The following exchange rates applied:  Assuming a forward contract was entered into on December 16, what would be the net impact on Car Corp.'s 2012 income statement related to this transaction?

Assuming a forward contract was entered into on December 16, what would be the net impact on Car Corp.'s 2012 income statement related to this transaction?

A) $500 (gain) .

B) $305 (gain) .

C) $300 (gain) .

D) $300 (loss) .

E) $0.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Larson Company, a U.S.company, has an India

Q23: What happens when a U.S. company purchases

Q27: On April 1, 2010, Shannon Company, a

Q29: On March 1, 2011, Mattie Company received

Q30: On November 10, 2011, King Co. sold

Q31: Coyote Corp. (a U.S. company in Texas)

Q31: Meisner Co.ordered parts costing §100,000 for a

Q35: On May 1, 2011, Mosby Company received

Q36: Mills Inc. had a receivable from a

Q72: What factors create a foreign exchange gain?