Multiple Choice

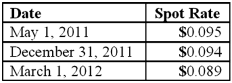

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2012. On May 1, 2011, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2012 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2011. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the impact on Mosby's 2012 net income as a result of this fair value hedge of a firm commitment?

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the impact on Mosby's 2012 net income as a result of this fair value hedge of a firm commitment?

A) $1,800.00 decrease.

B) $2,500.00 increase.

C) $2,500.00 decrease.

D) $188,760.60 increase.

E) $188,760.60 decrease.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: Which statement is true regarding a foreign

Q22: Larson Company, a U.S.company, has an India

Q23: What happens when a U.S. company purchases

Q30: On November 10, 2011, King Co. sold

Q31: Meisner Co.ordered parts costing §100,000 for a

Q31: Coyote Corp. (a U.S. company in Texas)

Q32: Car Corp. (a U.S.-based company) sold parts

Q36: Mills Inc. had a receivable from a

Q39: On May 1, 2011, Mosby Company received

Q49: On April 1, Quality Corporation, a U.S.