Multiple Choice

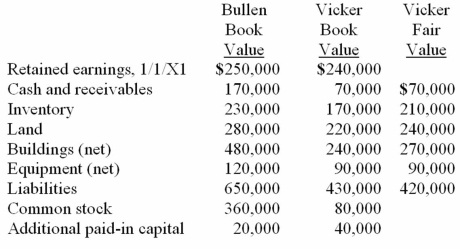

Bullen Inc. acquired 100% of the voting common stock of Vicker Inc. on January 1, 20X1. The book value and fair value of Vicker's accounts on that date (prior to creating the combination) follow, along with the book value of Bullen's accounts:  Assume that Bullen issued preferred stock with a par value of $240,000 and a fair value of $500,000 for all of the outstanding shares of Vicker in an acquisition business combination. What will be the balance in the consolidated Inventory and Land accounts?

Assume that Bullen issued preferred stock with a par value of $240,000 and a fair value of $500,000 for all of the outstanding shares of Vicker in an acquisition business combination. What will be the balance in the consolidated Inventory and Land accounts?

A) $440,000, $496,000.

B) $440,000, $520,000.

C) $425,000, $505,000.

D) $400,000, $500,000.

E) $427,000, $510,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Flynn acquires 100 percent of the outstanding

Q12: The financial balances for the Atwood Company

Q13: Carnes has the following account balances as

Q14: The following are preliminary financial statements for

Q15: The financial balances for the Atwood Company

Q17: The financial statements for Goodwin, Inc., and

Q19: On January 1, 20X1, the Moody Company

Q39: Which of the following statements is true

Q72: For each of the following situations, select

Q78: What is the primary difference between recording