Multiple Choice

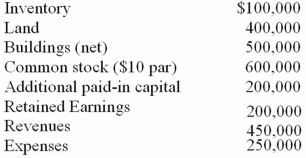

Carnes has the following account balances as of May 1, 2010 before an acquisition transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. At the date of acquisition, by how much does Riley's additional paid-in capital increase or decrease?

The fair value of Carnes' Land and Buildings are $650,000 and $550,000, respectively. On May 1, 2010, Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock. Riley paid $10,000 for costs to issue the new shares of stock. Before the acquisition, Riley has $700,000 in its common stock account and $300,000 in its additional paid-in capital account. At the date of acquisition, by how much does Riley's additional paid-in capital increase or decrease?

A) $0.

B) $440,000 increase.

C) $450,000 increase.

D) $640,000 increase.

E) $650,000 decrease.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: A statutory merger is a(n)<br>A) business combination

Q9: Flynn acquires 100 percent of the outstanding

Q10: Presented below are the financial balances for

Q11: Flynn acquires 100 percent of the outstanding

Q12: The financial balances for the Atwood Company

Q14: The following are preliminary financial statements for

Q15: The financial balances for the Atwood Company

Q16: Bullen Inc. acquired 100% of the voting

Q17: The financial statements for Goodwin, Inc., and

Q39: Which of the following statements is true