Multiple Choice

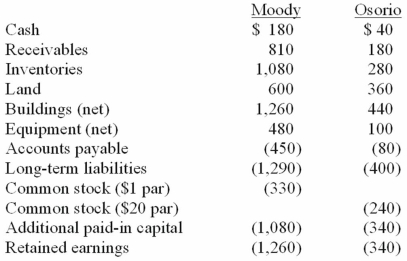

On January 1, 20X1, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Note: Parentheses indicate a credit balance. In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.

Compute the amount of consolidated land at date of acquisition.

A) $1,000.

B) $960.

C) $920.

D) $400.

E) $320.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Bullen Inc. acquired 100% of the voting

Q23: The financial statements for Jode Inc. and

Q24: The financial statements for Goodwin, Inc., and

Q25: The financial statements for Jode Inc. and

Q27: Salem Co. had the following account balances

Q29: The financial balances for the Atwood Company

Q30: The financial balances for the Atwood Company

Q31: On January 1, 20X1, the Moody Company

Q72: For each of the following situations, select

Q116: Fine Co. issued its common stock in