Essay

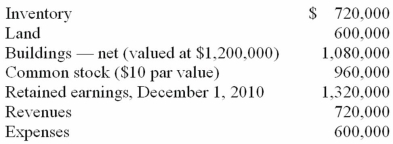

Salem Co. had the following account balances as of December 1, 2010:  Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock.

Bellington Inc. transferred $1.7 million in cash and 12,000 shares of its newly issued $30 par value common stock (valued at $90 per share) to acquire all of Salem's outstanding common stock.

Assume that Bellington paid cash of $2.8 million. No stock is issued. An additional $50,000 is paid in direct combination costs.

Required:

For Goodwill, determine what balance would be included in a December 1, 2010 consolidation.

Correct Answer:

Verified

Correct Answer:

Verified

Q22: Bullen Inc. acquired 100% of the voting

Q23: The financial statements for Jode Inc. and

Q24: The financial statements for Goodwin, Inc., and

Q25: The financial statements for Jode Inc. and

Q26: On January 1, 20X1, the Moody Company

Q29: The financial balances for the Atwood Company

Q30: The financial balances for the Atwood Company

Q31: On January 1, 20X1, the Moody Company

Q32: The financial balances for the Atwood Company

Q116: Fine Co. issued its common stock in