Multiple Choice

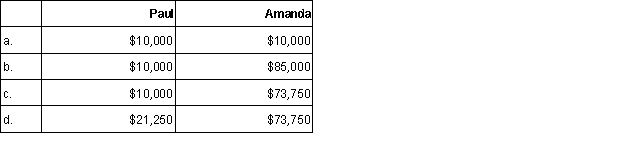

Paul invests $10,000 cash in an equipment leasing activity for a 15% ownership share in the business. The remaining 85% owner is Amanda. Amanda contributes $10,000 and personally borrows $75,000 that she also invests in the business. What are the at-risk amounts for Paul and Amanda?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Itemized deductions are allowed in their entirety

Q6: Oliver has an $80,000 loss from an

Q13: Jon is in the car rental business.Most

Q19: If a loss is disallowed under passive

Q24: Elijah owns an apartment complex that he

Q26: In 2015, Nigel contributes cash of $10,000

Q28: Antonio reported the following itemized deductions on

Q41: Which of the following is a passive

Q58: Tax preference items can be either positive

Q72: The standard deduction is added back as