Essay

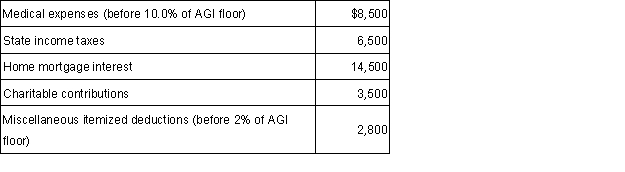

Antonio reported the following itemized deductions on his 2015 tax return. His AGI for 2015 was $95,000. The mortgage interest is all qualified mortgage interest to purchase his personal residence. For AMT, compute his total adjustment for itemized deductions.

Correct Answer:

Verified

Antonio's total AMT ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Paul invests $10,000 cash in an equipment

Q24: Elijah owns an apartment complex that he

Q26: In 2015, Nigel contributes cash of $10,000

Q30: Jordan purchased a warehouse for $600,000. $100,000

Q32: Heather purchased furniture and fixtures (7-year property)

Q33: Baxter invested $50,000 in an activity in

Q41: Which of the following is a passive

Q43: Clio's hot dog stand is only open

Q59: The Tara Partnership (not involved in real

Q72: The standard deduction is added back as