Essay

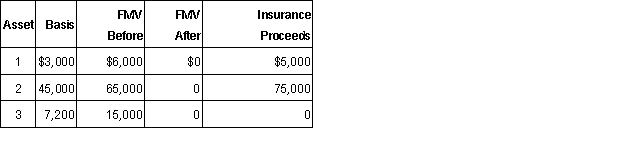

Knox operated a business which was damaged by a hurricane in 2015. His losses were as follows:  a. What is Knox's net casualty loss (if any) assuming his AGI is $85,000 prior the deduction? Assume he properly replaced all assets.

a. What is Knox's net casualty loss (if any) assuming his AGI is $85,000 prior the deduction? Assume he properly replaced all assets.

b. What is his basis in replacement Asset 1 purchased for $8,000 assuming Knox elected the non-recognition of gain from an involuntary conversion?

Correct Answer:

Verified

Correct Answer:

Verified

Q5: On June 15, 2015, Roco sold land

Q8: Dr. and Mrs. Spankle purchased a residence

Q10: A barn with an adjusted basis of

Q11: Jasmine sold land for $250,000 in 2015.

Q12: If one spouse sells a home and

Q23: Sanjay exchanges a warehouse he uses in

Q28: Laverne exchanges a rental beach house with

Q39: A wash sale occurs when a taxpayer

Q52: The installment method cannot be used to

Q72: Lee sells equipment (basis $10,000)to related party,Lee