Multiple Choice

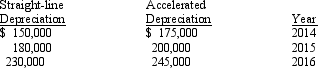

The Max Company began its operations on January 1, 2014, and used an accelerated method of depreciation for its machinery and equipment. On January 1, 2016, Max adopted the straight-line method of depreciation. The following information is available regarding depreciation expense for each method:

What is the before-tax cumulative effect on prior years' income that would be reported as of January 1, 2016, due to changing to a different depreciation method?

A) $0

B) a decrease of $45,000

C) an increase of $45,000

D) an increase of $60,000

Correct Answer:

Verified

Correct Answer:

Verified

Q29: When a change in method is inseparable

Q38: What are the two methods for reporting

Q73: A counterbalancing error will automatically correct itself

Q85: Prospective adjustments are expected to<br>A)impact financial statements

Q121: The Opal Company was incorporated and began

Q122: Several items related to accounting changes appear

Q125: Langley Company received merchandise on December 31,

Q126: Exhibit 22-5<br>Daniel Company, having a fiscal

Q128: The following are independent events: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6205/.jpg"

Q129: The 2014 and 2015 financial statements for