Essay

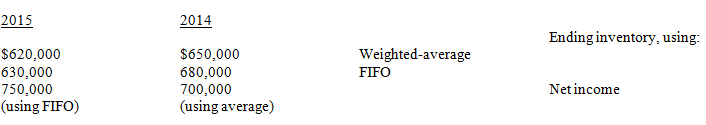

The Opal Company was incorporated and began operations on January 1, 2014. Opal used the weighted-average method for costing inventories. Effective January 1, 2015, Opal changed to FIFO for costing inventories and can justify the change. Information related to 2014 and 2015 inventory cost and net income is presented below:

Opal's income tax rate is 30% for both 2014 and 2015.

Required:

Calculate the amount of the cumulative effect of the change on beginning retained earnings on January 1, 2015, that would appear on Opal's statement of retained earnings for the year ended December 31, 2015.

Correct Answer:

Verified

_TB6205_00...

_TB6205_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q25: A change in accounting estimate does not

Q29: When a change in method is inseparable

Q38: What are the two methods for reporting

Q85: Prospective adjustments are expected to<br>A)impact financial statements

Q117: On January 1, Year 1, the Dole

Q118: The Jack Company began its operations on

Q122: Several items related to accounting changes appear

Q124: The Max Company began its operations on

Q125: Langley Company received merchandise on December 31,

Q126: Exhibit 22-5<br>Daniel Company, having a fiscal