Multiple Choice

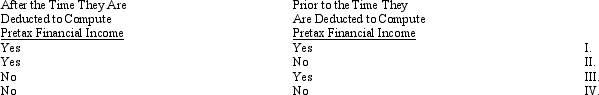

Temporary differences arise when expenses or losses are deducted to compute taxable income

A) I

B) II

C) III

D) IV

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: The recognition of gross profit on installment

Q12: Interperiod tax allocation is required for all

Q21: Deferred tax liabilities and deferred tax assets

Q29: What is intraperiod tax allocation?

Q51: All of the following involve a temporary

Q98: Lakeland Corporation reported the following pretax (and

Q101: The presentation of the combination or "offsetting"

Q102: As of December 31, 2014, the Williamsburg

Q106: Rehobeth Company's taxable income and other financial

Q107: On December 31, 2014, the Town Hall