Essay

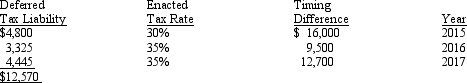

On December 31, 2014, the Town Hall Company had a deferred tax liability balance of $12,570, arising from an excess of MACRS depreciation for tax purposes over straight-line depreciation for accounting purposes. The tax effects of that timing difference are expected to reverse in the following years:

On January 27, 2015, Congress raised the effective income tax rate to 38% for all future years, including the current year, 2015.

Required:

Prepare the entry to record any adjustments necessary due to the income tax rate increase on January 27, 2015.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The recognition of gross profit on installment

Q12: Interperiod tax allocation is required for all

Q21: Deferred tax liabilities and deferred tax assets

Q29: What is intraperiod tax allocation?

Q51: All of the following involve a temporary

Q98: Lakeland Corporation reported the following pretax (and

Q101: The presentation of the combination or "offsetting"

Q102: As of December 31, 2014, the Williamsburg

Q105: Temporary differences arise when expenses or losses

Q106: Rehobeth Company's taxable income and other financial