Essay

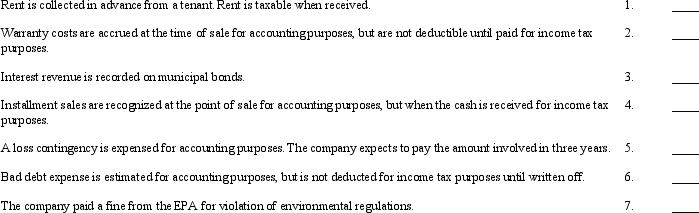

For each item listed below, indicate whether it involves a:

a.permanent difference.

b.temporary difference that will result in future deductible amounts (giving rise to deferred tax assets).

c.temporary difference that will result in future taxable amounts (giving rise to deferred tax liabilities).

Required:

Match each item to its descriptive phrase by placing the appropriate letter in the space provided.

Correct Answer:

Verified

_TB6205_00...

_TB6205_00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Identify the three essential characteristics of an

Q25: Which of the following statements regarding current

Q30: Which of the following transactions would typically

Q54: Interperiod income tax allocation is based on

Q83: On January 1, 2014, Bedrock Company began

Q86: Delmarva Company, during its first year of

Q87: James Company reports the following information related

Q90: Which of the following are required disclosures

Q92: What conclusion did FASB come to in

Q93: At the end of its first year