Essay

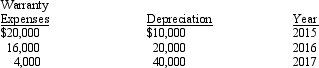

Delmarva Company, during its first year of operations in 2014, reported taxable income of $170,000 and pretax financial income of $100,000. The difference between taxable income and pretax financial income was caused by two timing differences: excess depreciation on tax return, $70,000; and warranty expenses in excess of warranty payments, $40,000. These two timing differences will reverse in the next three years as follows:

Enacted tax rates are 30% for 2014, 35% for 2015 and 2016, and 40% for 2017.

Required:

Prepare the income tax journal entry for Delmarva Company for December 31, 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Identify the three essential characteristics of an

Q25: Which of the following statements regarding current

Q30: Which of the following transactions would typically

Q52: Life insurance proceeds payable to a corporation

Q54: Interperiod income tax allocation is based on

Q82: In 2014, its first year of operations,

Q83: On January 1, 2014, Bedrock Company began

Q87: James Company reports the following information related

Q88: For each item listed below, indicate whether

Q90: Which of the following are required disclosures