Essay

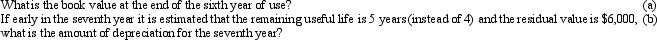

Equipment costing $80,000 with a useful life of 10 years and a residual value of $8,000 has been depreciated for 6 years by the straight-line method. Assume a fiscal year ending December 31.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q34: The calculation for annual depreciation using the

Q41: The units of production depreciation method provides

Q45: The proper journal entry to purchase a

Q46: Identify the following as a Fixed Asset

Q49: On December 31 it was estimated that

Q51: A double-declining balance rate for calculating depreciation

Q51: When depreciation estimates are revised, all years

Q103: Expenditures for research and development are generally

Q130: It is necessary for a company to

Q174: Regardless of the depreciation method, the amount