Essay

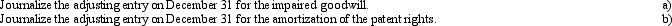

On December 31 it was estimated that goodwill of $65,000 was impaired. In addition, a patent with an estimated useful economic life of 10 years was acquired for $60,000 on July 1.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q34: The calculation for annual depreciation using the

Q41: The units of production depreciation method provides

Q45: The proper journal entry to purchase a

Q46: Identify the following as a Fixed Asset

Q50: Equipment costing $80,000 with a useful life

Q51: A double-declining balance rate for calculating depreciation

Q51: When depreciation estimates are revised, all years

Q130: It is necessary for a company to

Q155: Financial Statement data for the years ended

Q174: Regardless of the depreciation method, the amount