Essay

Depreciation and disposal--a comprehensive problem

Domino, Inc uses straight-line depreciation with a half-year convention in its financial statements. On March 10, 2006, Domino acquired a computer system at a cost of $98,800. Estimated useful life is six years, with residual value of $5,200.

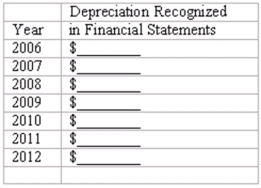

(a) Complete the following schedule, showing depreciation expense Domino expects to recognize each year in the financial statements.

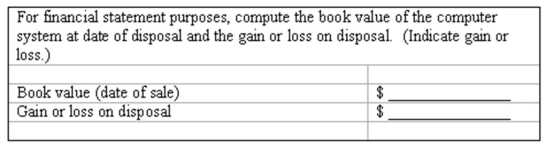

(b) Assume Domino sells the computer system on October 3, 2009, for $26,650.

Correct Answer:

Verified

(a) Depreciation Rec...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: The inclusion of the intangible asset goodwill

Q48: The book value of an asset is

Q61: Once the estimated life is determined for

Q66: To capitalize an expenditure means charging it

Q88: Determining cost of plant assets<br>New equipment was

Q105: The basic purpose of the matching principle

Q112: Evergreen Mfg. is a rapidly growing company

Q114: In February 2009, Brilliant Industries purchased the

Q119: Four events pertaining to plant assets are

Q120: Refer to the information above. Assume that