Essay

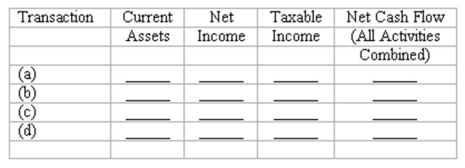

Four events pertaining to plant assets are described below.

(a) Computed depreciation for use in the annual income tax return (a different method is used in the financial statements).

(b) Made a year-end adjusting entry to record depreciation expense for financial reporting purposes.

(c) Sold old equipment for cash at a price below its book value, but above its income tax basis.

(d) Traded an old automobile in on a new one. The dealer granted a trade-in allowance on the old vehicle that was substantially above its book value and its tax basis. However, the trade-in allowance amounted to only a small portion of the price of the new car; most of the purchase price was paid in cash.

Indicate the immediate effects of each of these events upon the financial measurements in the four column headings listed below. Use the code letters, I for increase, D for decrease, and NE for no effect.

Note: Indicate only the immediate effects of each transaction. Do not attempt to anticipate how changes in taxable income will affect future cash flows.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: The inclusion of the intangible asset goodwill

Q61: Once the estimated life is determined for

Q66: To capitalize an expenditure means charging it

Q88: Determining cost of plant assets<br>New equipment was

Q97: Which depreciation method is most commonly used

Q105: The basic purpose of the matching principle

Q114: In February 2009, Brilliant Industries purchased the

Q117: Depreciation and disposal--a comprehensive problem<br>Domino, Inc uses

Q120: Refer to the information above. Assume that

Q124: The term net identifiable assets means:<br>A) All