Multiple Choice

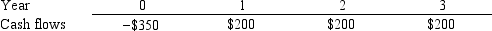

Garner Inc.is considering a project that has the following cash flow data.What is the project's payback?

A) 1.42 years

B) 1.58 years

C) 1.75 years

D) 1.93 years

E) 2.12 years

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q71: When considering two mutually exclusive projects, the

Q72: Which of the following statements is CORRECT?

Q73: Farmer Co.is considering Projects S and L,

Q74: Craig's Car Wash Inc.is considering a project

Q75: Both the regular and the modified IRR

Q77: Which of the following statements is CORRECT?

Q78: Last month, Standard Systems analyzed the project

Q79: A basic rule in capital budgeting is

Q80: Which of the following statements is CORRECT?<br>A)

Q81: Yoga Center Inc.is considering a project that