Multiple Choice

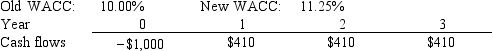

Last month, Standard Systems analyzed the project whose cash flows are shown below.However, before the decision to accept or reject the project took place, the Federal Reserve changed interest rates and therefore the firm's WACC.The Fed's action did not affect the forecasted cash flows.By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's expected NPV can be negative, in which case it should be rejected.

A) -$18.89

B) -$19.88

C) -$20.93

D) -$22.03

E) -$23.13

Correct Answer:

Verified

Correct Answer:

Verified

Q73: Farmer Co.is considering Projects S and L,

Q74: Craig's Car Wash Inc.is considering a project

Q75: Both the regular and the modified IRR

Q76: Garner Inc.is considering a project that has

Q77: Which of the following statements is CORRECT?

Q79: A basic rule in capital budgeting is

Q80: Which of the following statements is CORRECT?<br>A)

Q81: Yoga Center Inc.is considering a project that

Q82: Projects C and D both have normal

Q83: Which of the following statements is CORRECT?<br>A)