Multiple Choice

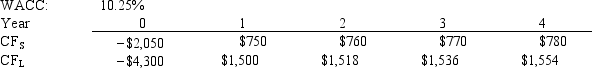

Projects S and L, whose cash flows are shown below, are mutually exclusive, equally risky, and not repeatable.Hooper Inc.is considering which of these two projects to undertake.If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the project with the higher IRR will also have the higher NPV, so no value will be lost if the IRR method is used.

A) $134.79

B) $141.89

C) $149.36

D) $164.29

E) $205.36

Correct Answer:

Verified

Correct Answer:

Verified

Q98: If you were evaluating two mutually exclusive

Q99: Poder Inc.is considering a project that has

Q100: Which of the following statements is CORRECT?<br>A)

Q101: In theory, capital budgeting decisions should depend

Q102: Assume a project has normal cash flows.All

Q103: Normal Projects S and L have the

Q104: Pet World is considering a project that

Q105: Current Design Co.is considering two mutually exclusive,

Q107: Clifford Company is choosing between two projects.The

Q108: Shannon Co.is considering a project that has