Multiple Choice

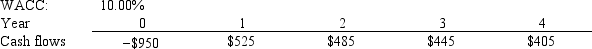

Shannon Co.is considering a project that has the following cash flow and WACC data.What is the project's discounted payback?

A) 1.61 years

B) 1.79 years

C) 1.99 years

D) 2.22 years

E) 2.44 years

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q98: If you were evaluating two mutually exclusive

Q99: Poder Inc.is considering a project that has

Q100: Which of the following statements is CORRECT?<br>A)

Q101: In theory, capital budgeting decisions should depend

Q102: Assume a project has normal cash flows.All

Q103: Normal Projects S and L have the

Q104: Pet World is considering a project that

Q105: Current Design Co.is considering two mutually exclusive,

Q106: Projects S and L, whose cash flows

Q107: Clifford Company is choosing between two projects.The