Multiple Choice

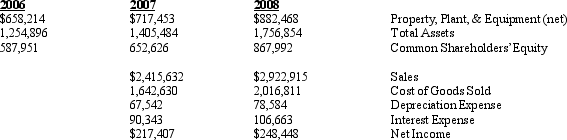

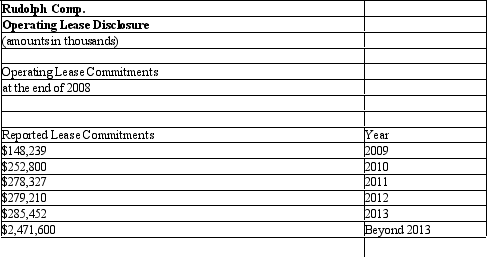

NOTE: These multiple choice questions require present value information. Rudolph Corporation manufactures Christmas decorations and supplies throughout the world. The company owns property, plant, and equipment and also enters into operating leases for certain facilities. Assume that Randolph's incremental borrowing rate is 8%. The company's tax rate is 40%. Listed below is selected financial data for Rudolph and a portion of the company's operating lease footnote.

Using the information provided by Rudolph Corporation calculate the present value of the operating leases.

Using the information provided by Rudolph Corporation calculate the present value of the operating leases.

A) $2,155,843

B) $2,024,945

C) $1,482,390

D) $2,854,452

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Please answer the following questions about defined

Q7: NOTE: This problem requires present value

Q9: A _ lease arrangement is one in

Q19: A security that has both equity and

Q28: The lessor in a capital lease recognizes

Q50: When firms use derivatives effectively to manage

Q60: One criteria that must be satisfied for

Q62: A minimum liability for pension expense is

Q66: To calculate a company's average tax rate

Q85: _ differences arise from revenues and expenses