Multiple Choice

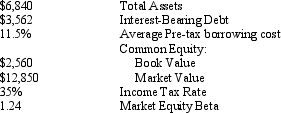

Zolar Corp. The following data pertains to Zolar Corp., a manufacturer of ball bearings (dollar amounts in millions) : Using the above information, calculate Zolar's weighted-average cost of capital:

Using the above information, calculate Zolar's weighted-average cost of capital:

A) 11.5%

B) 11.89%

C) 7.48%

D) 10.90%

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: The following data pertain to LDP Corporation<br>(dollar

Q5: LA Sunglasses operates retail sunglass kiosks in

Q7: One rational for using expected dividends in

Q11: Zolar Corp. The following data pertains to

Q14: In some valuation scenarios, such as a

Q18: Zonk Corp.<br>The following data pertains to

Q20: Which of the following is not a

Q21: A company with a market beta of

Q33: In what case will using dividends expected

Q41: Because the market equity beta reflects the