Essay

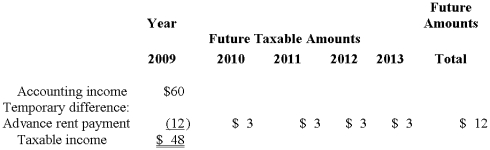

The following information is for Hulk Gyms' first year of operations. Amounts are in millions of dollars. The enacted tax rate is 30%.

Required:

Prepare a compound journal entry to record the income tax expense for the year 2009. Show well-labeled computations.

Correct Answer:

Verified

Correct Answer:

Verified

Q17: Puritan Corp. reported the following pretax accounting

Q18: What should Kent report as the current

Q20: Due to differences between depreciation reported in

Q23: SFAS 109 requires the following procedure.<br>A)Computation of

Q24: In its first four years of operations

Q25: Which of the following differences between financial

Q26: Gore Company, organized on January 2,

Q106: Some accountants believe that deferred taxes should

Q126: In LMC's 2018 annual report to shareholders,

Q175: When a new tax rate is enacted,