Short Answer

Figure 8-26

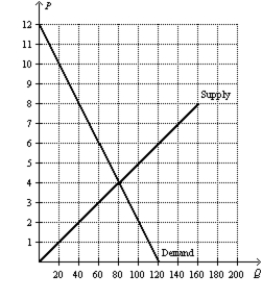

-Refer to Figure 8-26.Suppose the government places a $3 tax per unit on this good.What price will sellers receive for the good after the tax is imposed?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Figure 8-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-25

Q4: Scenario 8-3<br>Suppose the market demand and market

Q5: Figure 8-26 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-26

Q6: Figure 8-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-25

Q7: Scenario 8-3<br>Suppose the market demand and market

Q9: Figure 8-25 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-25

Q10: Figure 8-26 <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2297/.jpg" alt="Figure 8-26

Q13: Provide several examples of important taxes on

Q115: A tax is imposed on a certain

Q199: Suppose the demand curve and the supply