Multiple Choice

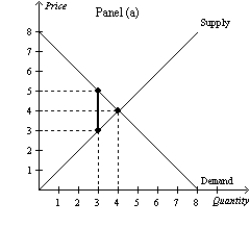

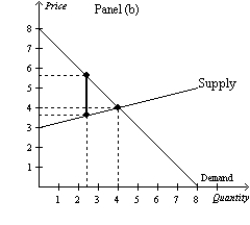

Figure 8-16

-Refer to Figure 8-16.Panel (a) and Panel (b) each illustrate a $2 tax placed on a market.In comparison to Panel (b) ,Panel (a) illustrates which of the following statements?

A) When demand is relatively inelastic,the deadweight loss of a tax is smaller than when demand is relatively elastic.

B) When demand is relatively elastic,the deadweight loss of a tax is larger than when demand is relatively inelastic.

C) When supply is relatively inelastic,the deadweight loss of a tax is smaller than when supply is relatively elastic.

D) When supply is relatively elastic,the deadweight loss of a tax is larger than when supply is relatively inelastic.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Economists generally agree that the most important

Q3: The deadweight loss from a tax of

Q4: Taxes on labor encourage which of the

Q5: Labor taxes may distort labor markets greatly

Q6: The deadweight loss from a $3 tax

Q7: Suppose that policymakers are considering placing a

Q9: Suppose a tax of $1 per unit

Q10: Which of the following is a tax

Q11: Assume the supply curve for cigars is

Q181: Suppose the government imposes a tax on