Multiple Choice

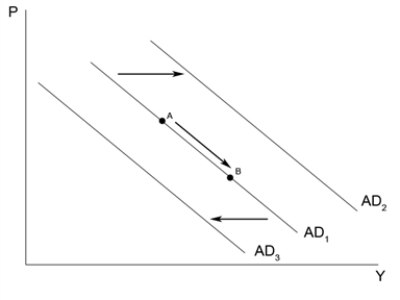

Figure 34-8

-Refer to Figure 34-8.An increase in taxes will

A) shift aggregate demand from AD1 to AD2.

B) shift aggregate demand from AD1 to AD3.

C) cause movement from point A to point B along AD1.

D) have no effect on aggregate demand.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q109: An aide to a U.S.Congressman computes the

Q110: If the multiplier is 6 and if

Q111: If the multiplier is 5.25,then the MPC

Q112: A tax increase has<br>A)a multiplier effect but

Q113: As real GDP falls,<br>A)money demand rises,so the

Q115: Figure 34-6.On the left-hand graph,MS represents the

Q116: Which of the following events shifts aggregate

Q117: Suppose there are both multiplier and crowding

Q118: If the MPC = 0.75,then the government

Q119: Which of the following tends to make