Multiple Choice

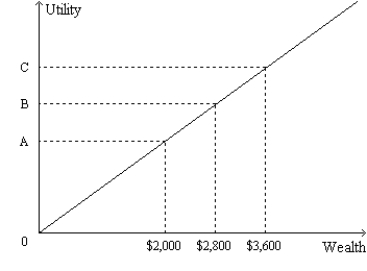

Figure 27-4.The figure shows a utility function for Alex.

-Refer to Figure 27-4.From the appearance of Alex's utility function,we know that

A) if Alex owns a house,then he definitely would buy fire insurance provided the cost of the insurance was reasonable.

B) Alex would voluntarily exchange a portfolio of stocks with a high average return and a high level of risk for a portfolio with a low average return and a low level of risk.

C) Alex is risk averse.

D) Alex is not risk averse.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: In effect,an annuity provides insurance<br>A)against the risk

Q3: Kyle puts a greater proportion of his

Q5: Chloe talked to several stockbrokers and made

Q6: An increase in the number of corporations

Q7: Consider the following two situations.Irene accepts a

Q9: Which of the following is adverse selection?<br>A)the

Q10: Which of the following is not correct?<br>A)The

Q11: Figure 27-5.The figure shows a utility function

Q126: The largest reduction in a portfolio's risk

Q151: Kayla faces risks and she pays a