Essay

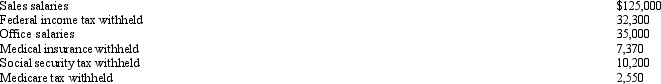

The summary of the payroll for the monthly pay period ending July 15 indicated the following:

Journalize the entries to record (a) the payroll and (b) the employer's payroll tax expense for the month. The state unemployment tax rate is 3.1%, and the federal unemployment tax rate is 0.8%. Only $25,000 of salaries are subject to unemployment taxes.

Journalize the entries to record (a) the payroll and (b) the employer's payroll tax expense for the month. The state unemployment tax rate is 3.1%, and the federal unemployment tax rate is 0.8%. Only $25,000 of salaries are subject to unemployment taxes.

Correct Answer:

Verified

(a)

_TB20...

_TB20...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Receiving payment prior to delivering goods or

Q52: The employee earnings record would contain which

Q54: The journal entry a company uses to

Q55: A current liability is a debt that

Q56: For Company A and Company B:<br> <img

Q59: For which of the following taxes is

Q60: Excel Products Inc. pays its employees semimonthly.

Q61: Which of the following will have no

Q62: The following totals for the month of

Q158: List five internal controls that relate directly