Essay

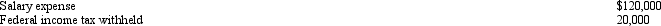

Excel Products Inc. pays its employees semimonthly. The summary of the payroll for December 31, 2012 indicated the following:

For the year ended 2012, $40,000 of the December 31 payroll is subject to social security tax of 6%; $120,000 is subject to Medicare tax of 1.5%; $10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%. As of January 1, 2013 all of the $120,000 is subject to all payroll taxes. Present the journal entries for payroll tax expense if the employees are paid (a) December 31 of the current year, (b) January 2 of the following year.

For the year ended 2012, $40,000 of the December 31 payroll is subject to social security tax of 6%; $120,000 is subject to Medicare tax of 1.5%; $10,000 is subject to state unemployment tax of 4.3% and federal unemployment tax of 0.8%. As of January 1, 2013 all of the $120,000 is subject to all payroll taxes. Present the journal entries for payroll tax expense if the employees are paid (a) December 31 of the current year, (b) January 2 of the following year.

Correct Answer:

Verified

(a)

_TB20...

_TB20...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: Receiving payment prior to delivering goods or

Q55: A current liability is a debt that

Q56: For Company A and Company B:<br> <img

Q57: The summary of the payroll for the

Q59: For which of the following taxes is

Q61: Which of the following will have no

Q62: The following totals for the month of

Q63: The Core Company had the following assets

Q65: Proper payroll accounting methods are important for

Q183: Chang Co. issued a $50,000, 120-day, discounted