Essay

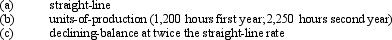

Equipment purchased at the beginning of the fiscal year for $360,000 is expected to have a useful life of 5 years, or 14,000 operating hours, and a residual value of $10,000. Compute the depreciation for the first and second years of use by each of the following methods:

(Round the answer to the nearest dollar.)

(Round the answer to the nearest dollar.)

Correct Answer:

Verified

Correct Answer:

Verified

Q51: When depreciation estimates are revised, all years

Q98: When minor errors occur in the estimates

Q99: Identify each of the following expenditures as

Q100: Equipment costing $80,000 with a useful life

Q102: An asset was purchased for $120,000 on

Q104: A capitalized asset will appear on the

Q107: To a major resort, timeshare properties would

Q108: What is the cost of the land,

Q191: In a lease contract, the party who

Q212: A characteristic of a fixed asset is