Essay

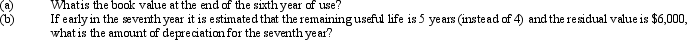

Equipment costing $80,000 with a useful life of 10 years and a residual value of $8,000 has been depreciated for 6 years by the straight-line method. Assume a fiscal year ending December 31.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q78: When a seller allows a buyer an

Q95: Computer equipment (office equipment) purchased 6 1/2

Q98: When minor errors occur in the estimates

Q99: Identify each of the following expenditures as

Q102: An asset was purchased for $120,000 on

Q103: Equipment purchased at the beginning of the

Q104: A capitalized asset will appear on the

Q123: A gain can be realized when a

Q191: In a lease contract, the party who

Q212: A characteristic of a fixed asset is