Essay

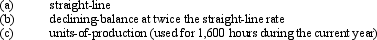

Machinery is purchased on July 1 of the current fiscal year for $240,000. It is expected to have a useful life of 4 years, or 25,000 operating hours, and a residual value of $15,000. Compute the depreciation for the last six months of the current fiscal year ending December 31 by each of the following methods:

(Round the answer to the nearest dollar.)

(Round the answer to the nearest dollar.)

Correct Answer:

Verified

Correct Answer:

Verified

Q86: As a company records depreciation expense for

Q87: On June 1, 2014, Aaron Company purchased

Q88: An operating lease is accounted for as

Q93: A fixed asset with a cost of

Q94: Which of the following should be included

Q95: Computer equipment (office equipment) purchased 6 1/2

Q123: A gain can be realized when a

Q151: When a company establishes an outstanding reputation

Q168: A fixed asset's estimated value at the

Q172: Standby equipment held for use in the