Essay

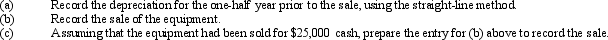

Computer equipment (office equipment) purchased 6 1/2 years ago for $170,000, with an estimated life of 8 years and a residual value of $10,000, is now sold for $60,000 cash. (Appropriate entries for depreciation had been made for the first six years of use.) Journalize the following entries:

Correct Answer:

Verified

Correct Answer:

Verified

Q78: When a seller allows a buyer an

Q91: Machinery is purchased on July 1 of

Q93: A fixed asset with a cost of

Q94: Which of the following should be included

Q98: When minor errors occur in the estimates

Q99: Identify each of the following expenditures as

Q100: Equipment costing $80,000 with a useful life

Q123: A gain can be realized when a

Q151: When a company establishes an outstanding reputation

Q168: A fixed asset's estimated value at the