Multiple Choice

Steven Parker owns and operates Steven's Septic Service and Legal Advice.Steven's two revenue generating (production) operations are supported by two service departments: Clerical and Janitorial.Costs in the service departments are allocated in the following order using the designated allocation bases: Clerical:

Variable cost: expected number of work orders processed

Fixed cost: long-run average number of work orders processed

Janitorial:

Variable cost: labor hours

Fixed cost: square footage of space occupied

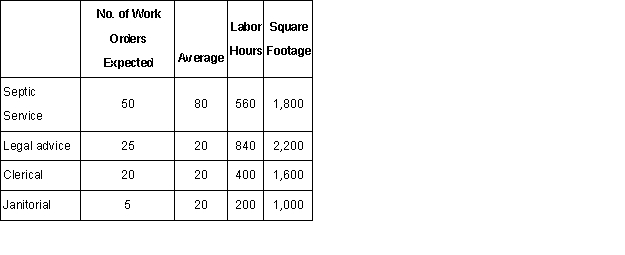

Average and expected activity levels for next month (June) are as follows: Expected costs in the service departments for June are as follows:

Expected costs in the service departments for June are as follows:

Under the step method of allocation,how much Clerical service cost should be allocated to the Septic Service operation for June? (Assume Clerical costs are allocated before Janitorial costs and round all calculations to the nearest whole dollar. )

A) $12,689.

B) $13,100.

C) $13,620.

D) $15,596.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Highlands,Inc.operates a sawmill facility.The company accounts for

Q12: The human resource department in a manufacturing

Q14: The following set up is a

Q16: Clean-Burn,Inc.is a small petroleum company that

Q17: Simpson Manufacturing Enterprises uses a joint production

Q18: Indicate whether the following costs would be

Q19: Cordner Corporation has two production Departments: P1

Q20: Bartoff Foods produces three supplemental food products

Q51: Which of the following best describes the

Q137: What is the difference between an intermediate