Essay

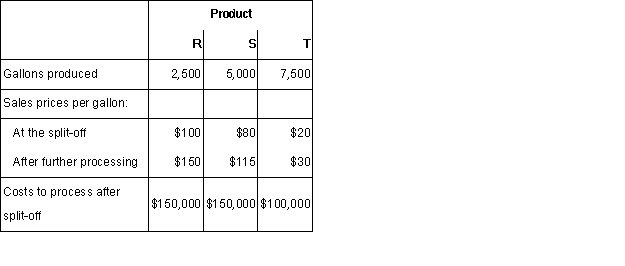

Simpson Manufacturing Enterprises uses a joint production process that produces three products at the split-off point.Joint production costs during April were $720,000.The company uses the net realizable value method for allocating joint costs.Product information for April was as follows:

Required:

a.Assume that all three products are main products and that they can be sold at the split-off point or processed further,whichever is economically beneficial to Simpson.Allocate the joint costs to the three products.b.Assume that Simpson uses the physical quantities method to allocate the joint costs.How much would be allocated to each of the three products?

Correct Answer:

Verified

a.R: $218,182;S: $370,909;T: $130,909

b....View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

b....

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: The human resource department in a manufacturing

Q14: The following set up is a

Q15: Steven Parker owns and operates Steven's

Q16: Clean-Burn,Inc.is a small petroleum company that

Q18: Indicate whether the following costs would be

Q19: Cordner Corporation has two production Departments: P1

Q20: Bartoff Foods produces three supplemental food products

Q21: The Hsu Manufacturing Company has two

Q22: Boswell Consulting has two service departments: S1

Q137: What is the difference between an intermediate