Multiple Choice

Steven Parker owns and operates Steven's Septic Service and Legal Advice.Steven's two revenue generating (production) operations are supported by two service departments: Clerical and Janitorial.Costs in the service departments are allocated in the following order using the designated allocation bases: Clerical:

Variable cost: expected number of work orders processed

Fixed cost: long-run average number of work orders processed

Janitorial:

Variable cost: labor hours

Fixed cost: square footage of space occupied

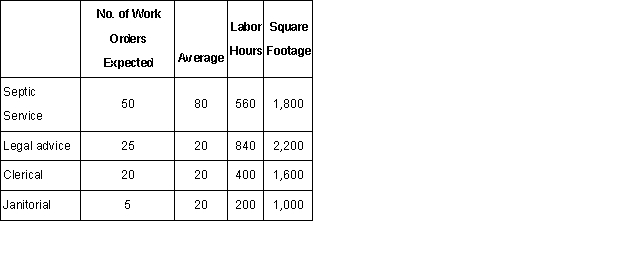

Average and expected activity levels for next month (June) are as follows: Expected costs in the service departments for June are as follows:

Expected costs in the service departments for June are as follows:

Under the direct method of allocation,what is the total amount of service cost allocated to the Legal Advice operation for June? (Round all calculations to the nearest whole dollar. )

A) $6,231.

B) $7,720.

C) $8,640.

D) $9,330.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Wimbledon Corporation has two production Departments: Assembly

Q37: The Macon Industries started the production of

Q38: Delite Confectionary Company produces various types of

Q39: Jack Donaldson owns and operates Jack's

Q41: Since by-products have minor sales value,alternative methods

Q42: Veneer Company has two service departments

Q45: If a company's two joint products can

Q48: Which of the following would be an

Q85: Explain the difference between the net realizable

Q88: Which of the following is not a