Multiple Choice

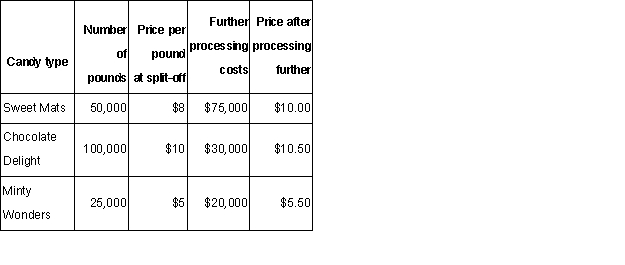

Delite Confectionary Company produces various types of candies.Several candies could be sold at the split-off point or processed further and sold in a different form after further processing.The candies are produced in a joint processing operation with $500,000 of joint processing costs monthly,which are allocated based on pounds produced.Information concerning this process for a recent month appears below:  The joint processing costs in this operation:

The joint processing costs in this operation:

A) should be allocated to products to determine whether they are sold at split-off or processed further.

B) should be ignored in determining whether to sell at split-off or process further.

C) should be ignored in making all product decisions.

D) are never included in product cost,as they are misleading to all management decisions.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Allocation of factory service department costs to

Q34: Jack Donaldson owns and operates Jack's

Q35: Wimbledon Corporation has two production Departments: Assembly

Q37: The Macon Industries started the production of

Q39: Jack Donaldson owns and operates Jack's

Q40: Steven Parker owns and operates Steven's

Q41: Since by-products have minor sales value,alternative methods

Q42: Veneer Company has two service departments

Q48: Which of the following would be an

Q88: Which of the following is not a