Multiple Choice

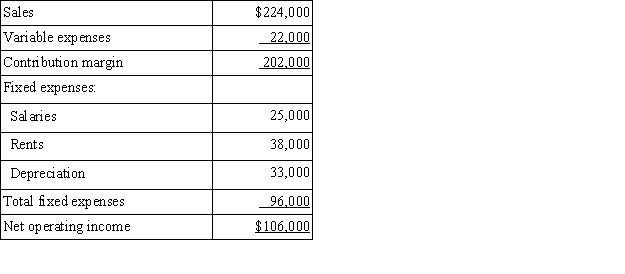

Neighbors Corporation is considering a project that would require an investment of $279,000 and would last for 8 years. The incremental annual revenues and expenses generated by the project during those 8 years would be as follows:  The scrap value of the project's assets at the end of the project would be $15,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

The scrap value of the project's assets at the end of the project would be $15,000. The cash inflows occur evenly throughout the year. The payback period of the project is closest to:

A) 2.0 years

B) 2.6 years

C) 2.5 years

D) 1.9 years

Correct Answer:

Verified

Correct Answer:

Verified

Q100: Pro-Mate, Inc. is a producer of athletic

Q101: Mercer Corporation is considering replacing a technologically

Q102: Tangen Corporation is considering the purchase of

Q103: Bill Anders retires in 5 years. He

Q104: Beaver Corporation is investigating the purchase of

Q106: Jimba's, Inc., has purchased a new donut

Q107: Vernon Corporation has been offered a 5-year

Q108: Messersmith Corporation is investigating automating a process

Q109: The management of Kleppe Corporation is investigating

Q110: The Halsey Corporation is contemplating the purchase