Multiple Choice

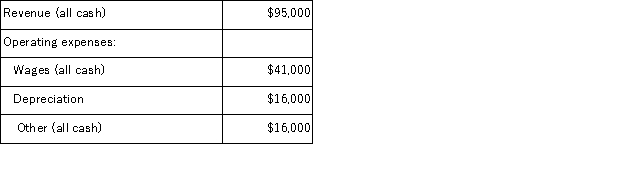

The Halsey Corporation is contemplating the purchase of new equipment that would require an initial investment of $125,000. The equipment would have a useful life of six years, with a salvage value of $29,000. This new equipment would be depreciated over its useful life by the straight-line method. It would replace existing equipment which is fully depreciated. The existing equipment has a salvage value now of $38,000. The anticipated annual revenues and expenses associated with the new equipment are:  Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project. The payback period is closest to:

Assume cash flows occur uniformly throughout a year except for the initial investment and the salvage value at the end of the project. The payback period is closest to:

A) 5.7 years

B) 4.0 years

C) 2.3 years

D) 1.8 years

Correct Answer:

Verified

Correct Answer:

Verified

Q85: Czlapinski Corporation is considering a capital budgeting

Q105: Neighbors Corporation is considering a project that

Q106: Jimba's, Inc., has purchased a new donut

Q107: Vernon Corporation has been offered a 5-year

Q108: Messersmith Corporation is investigating automating a process

Q109: The management of Kleppe Corporation is investigating

Q111: An expansion at Fidell, Inc., would increase

Q112: Correl Corporation has provided the following data

Q113: Cascade, Inc., has assembled the estimates shown

Q114: The management of Edelmann Corporation is considering