Multiple Choice

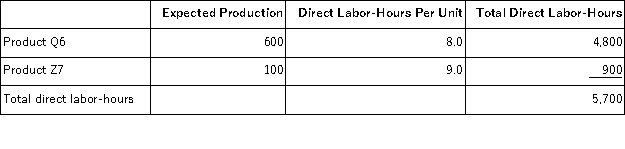

Aboud, Inc., manufactures and sells two products: Product Q6 and Product Z7. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $25.90 per DLH. The direct materials cost per unit for each product is given below:

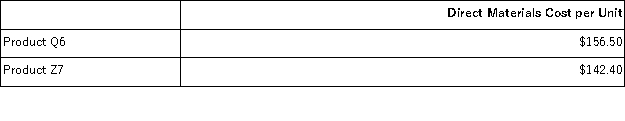

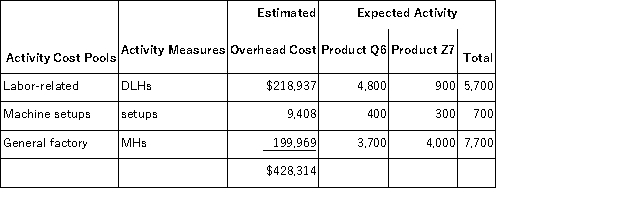

The direct labor rate is $25.90 per DLH. The direct materials cost per unit for each product is given below:  The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  The total overhead applied to Product Z7 under activity-based costing is closest to:

The total overhead applied to Product Z7 under activity-based costing is closest to:

A) $103,880

B) $67,626

C) $61,188

D) $142,481

Correct Answer:

Verified

Correct Answer:

Verified

Q43: Pachero, Inc., manufactures and sells two products:

Q44: In the past, Hypochondriac Hospital allocated all

Q45: Mouret Corporation uses the following activity rates

Q46: Mellencamp, Inc., manufactures and sells two products:

Q47: Dunnivan, Inc., manufactures and sells two products:

Q49: Betenbaugh, Inc., manufactures and sells two products:

Q50: Din, Inc., manufactures and sells two products:

Q51: Accurso, Inc., manufactures and sells two products:

Q53: Activity rates from Lippard Corporation's activity-based costing

Q217: When switching from a traditional costing system