Multiple Choice

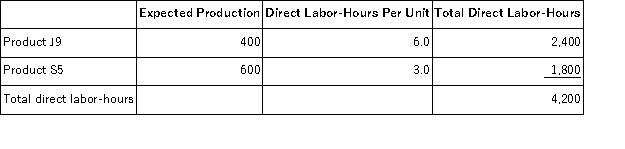

Accurso, Inc., manufactures and sells two products: Product J9 and Product S5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $22.50 per DLH. The direct materials cost per unit for each product is given below:

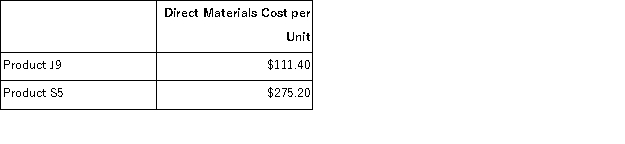

The direct labor rate is $22.50 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

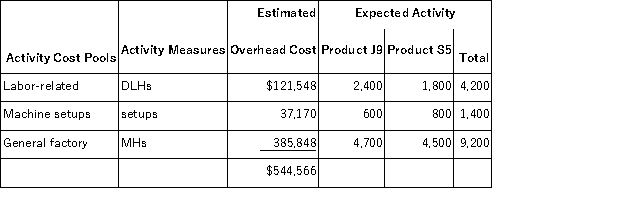

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product J9 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product J9 would be closest to:

A) $173.64 per unit

B) $251.64 per unit

C) $777.96 per unit

D) $159.30 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q46: Mellencamp, Inc., manufactures and sells two products:

Q47: Dunnivan, Inc., manufactures and sells two products:

Q48: Aboud, Inc., manufactures and sells two products:

Q49: Betenbaugh, Inc., manufactures and sells two products:

Q50: Din, Inc., manufactures and sells two products:

Q53: Activity rates from Lippard Corporation's activity-based costing

Q54: When designing an activity-based costing system, accountants

Q55: Material handling is an example of a:<br>A)Unit-level

Q56: Uson, Inc., manufactures and sells two products:

Q217: When switching from a traditional costing system