Multiple Choice

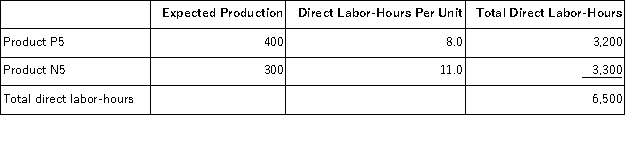

Paolello, Inc., manufactures and sells two products: Product P5 and Product N5. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $24.60 per DLH. The direct materials cost per unit for each product is given below:

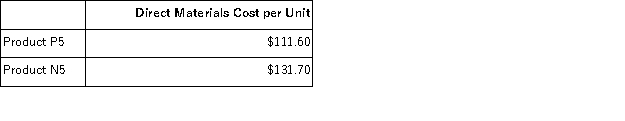

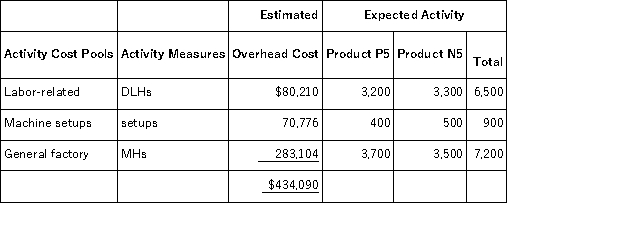

The direct labor rate is $24.60 per DLH. The direct materials cost per unit for each product is given below:  The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:

The company is considering adopting an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product P5 would be closest to:

If the company allocates all of its overhead based on direct labor-hours using its traditional costing method, the overhead assigned to each unit of Product P5 would be closest to:

A) $629.12 per unit

B) $98.72 per unit

C) $534.24 per unit

D) $314.56 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q198: Neldon, Inc., manufactures and sells two products:

Q199: Moul, Inc., manufactures and sells two products:

Q200: Betenbaugh, Inc., manufactures and sells two products:

Q201: Activity-based costing involves a two-stage allocation process

Q202: Brenneis, Inc., manufactures and sells two products:

Q203: Would the following activities at a manufacturer

Q204: Cassano, Inc., manufactures and sells two products:

Q205: Minon, Inc., manufactures and sells two products:

Q206: Mcleese, Inc., manufactures and sells two products:

Q208: Sow, Inc., manufactures and sells two products: