Essay

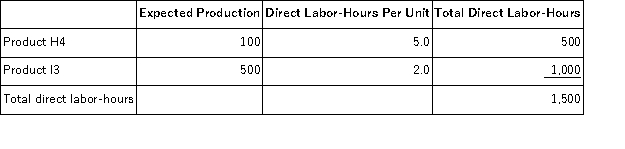

Jaure, Inc., manufactures and sells two products: Product H4 and Product I3. Data concerning the expected production of each product and the expected total direct labor-hours (DLHs) required to produce that output appear below:  The direct labor rate is $29.40 per DLH. The direct materials cost per unit is $244.70 for Product H4 and $206.20 for Product I3.

The direct labor rate is $29.40 per DLH. The direct materials cost per unit is $244.70 for Product H4 and $206.20 for Product I3.

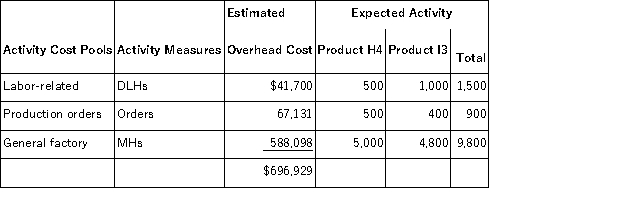

The company has an activity-based costing system with the following activity cost pools, activity measures, and expected activity:  Required:

Required:

a. Compute the activity rates under the activity-based costing system.

b. Determine how much overhead would be assigned to each product under the activity-based costing system.

c. Determine the unit product cost of each product under the activity-based costing method.

Correct Answer:

Verified

Computation of activity rates:...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q96: Frogge, Inc., manufactures and sells two products:

Q97: Serva, Inc., manufactures and sells two products:

Q98: Sepulvado, Inc., manufactures and sells two products:

Q99: Onstad, Inc., manufactures and sells two products:

Q100: Sampaga, Inc., manufactures and sells two products:

Q102: Direct labor is an appropriate allocation base

Q103: Brenneis, Inc., manufactures and sells two products:

Q104: Swimm Company allocates materials handling cost to

Q105: Kamerling, Inc., manufactures and sells two products:

Q106: Schoeninger, Inc., manufactures and sells two products: